The global formaldehyde market stood at a volume of approximately 22,780 KT in 2023 and is projected to grow at a CAGR of 3.40% between 2025 and 2034, reaching around 30,510 KT by 2032. Similarly, the acetic acid market is experiencing strong growth due to its widespread use in industrial chemicals, food preservation, pharmaceuticals, and plastic production. As industries transition towards sustainable and bio-based chemical production, acetic acid remains a vital compound for numerous applications.

Understanding Acetic Acid

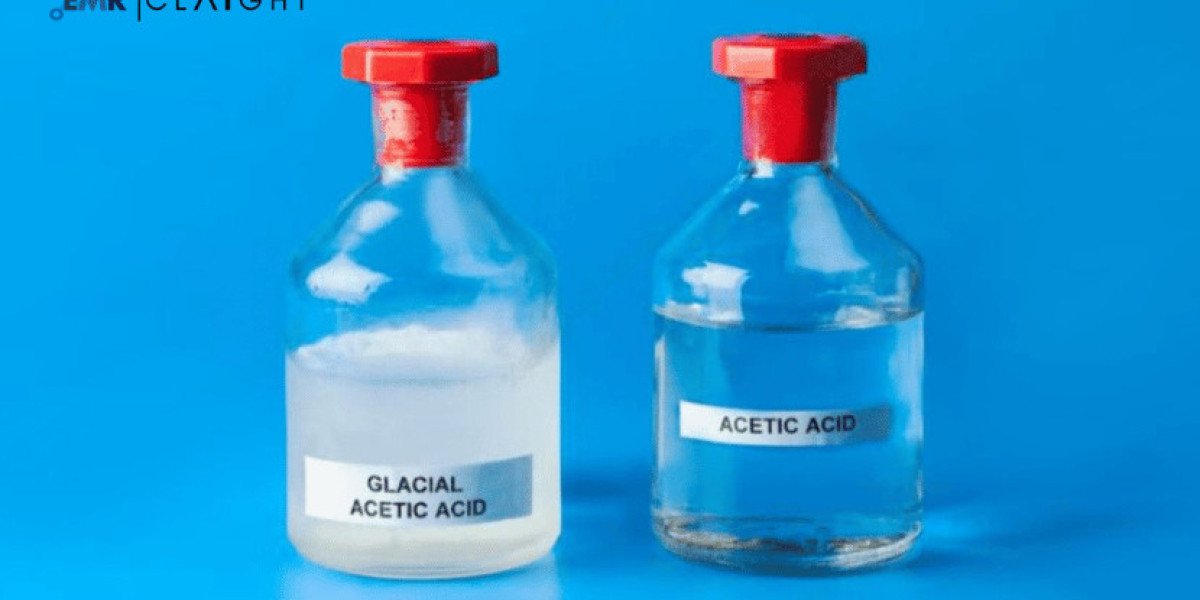

What is Acetic Acid?

Acetic acid (CH₃COOH) is an organic carboxylic acid primarily used in chemical synthesis, food processing, textile manufacturing, and medical applications. It serves as a precursor for various acetate-based compounds and is widely utilized in multiple industries due to its solvent properties and antimicrobial characteristics.

Get a Free Sample Report with Table of Contents@ https://www.expertmarketresearch.com/industry-statistics/acetic-acid-market/requestsample

Key Applications of Acetic Acid

- Vinyl Acetate Monomer (VAM): Essential in the production of adhesives, coatings, and paints.

- Acetate Esters: Used in solvents for inks, coatings, and fragrances.

- Purified Terephthalic Acid (PTA): A critical ingredient in polyester and PET bottle production.

- Food Industry: Used as a food preservative and acid regulator in vinegar.

- Pharmaceuticals: Applied in antiseptics and drug formulations.

- Textile Industry: Utilized in synthetic fiber production and dyeing processes.

Market Trends and Growth Drivers

1. Increasing Demand for Vinyl Acetate Monomer (VAM)

VAM production accounts for a significant portion of acetic acid consumption, driven by its use in adhesives, sealants, and coatings. The construction, packaging, and automotive industries are major contributors to the rising demand for VAM-based materials.

2. Growing Applications in the Food and Beverage Industry

Acetic acid is a key ingredient in vinegar and food preservatives, making it indispensable for the food processing sector. With increased consumer awareness of natural and organic food preservation, the market for acetic acid in food applications continues to expand.

3. Expansion in PET and Polyester Manufacturing

With the global demand for polyethylene terephthalate (PET) in packaging and textiles surging, the requirement for acetic acid in PTA production is also rising. The push toward recyclable PET bottles and sustainable fibers further strengthens market prospects.

4. Technological Advancements in Acetic Acid Production

- Bio-Based Acetic Acid: Companies are investing in bio-fermentation processes to produce sustainable and renewable acetic acid.

- Catalytic Process Optimization: Advancements in methanol carbonylation and oxidative fermentation are improving efficiency and yield.

- High-Purity Acetic Acid for Specialty Applications: The growing electronics and pharmaceutical sectors are driving demand for ultra-pure acetic acid.

5. Sustainability and Regulatory Compliance

Governments and regulatory bodies are enforcing environmental regulations that encourage:

- Reduction in carbon emissions from chemical production.

- Adoption of bio-based alternatives to petroleum-derived acetic acid.

- Implementation of green chemistry initiatives in industrial manufacturing.

Challenges in the Acetic Acid Market

1. Fluctuations in Raw Material Prices

Acetic acid production relies heavily on methanol and natural gas, both of which are subject to price volatility based on crude oil markets and supply chain disruptions.

2. Environmental and Health Concerns

- Emission control policies affecting chemical manufacturing plants.

- Safe handling and disposal challenges for industrial acetic acid.

- Rising competition from non-toxic and biodegradable alternatives.

3. Competition from Alternative Chemicals

Acetic acid faces growing competition from green solvents, organic acids, and synthetic alternatives that offer lower toxicity and better sustainability credentials.

Future Outlook and Market Projections

Global Market Forecast (2024-2032)

The acetic acid market is expected to grow at a CAGR of 4.8% from 2024 to 2032, fueled by:

- Expanding applications in PET production, adhesives, and food preservatives.

- Advancements in bio-based acetic acid production.

- Increased investment in sustainable chemical solutions.

Regional Insights

- Asia-Pacific: The largest and fastest-growing market, with China, India, and Japan leading in acetic acid production and consumption.

- North America: Strong demand from food processing, pharmaceuticals, and packaging industries.

- Europe: Focus on eco-friendly acetic acid alternatives and regulatory compliance.

- Middle East & Latin America: Increasing industrialization and infrastructure development fueling market growth.

Key Industry Players

Leading companies shaping the acetic acid market include:

- Celanese Corporation

- Eastman Chemical Company

- LyondellBasell Industries

- British Petroleum (BP) plc

- Daicel Corporation

- Saudi Basic Industries Corporation (SABIC)

- Wacker Chemie AG

Conclusion

The acetic acid market is poised for significant growth, driven by its applications in chemical synthesis, food preservation, PET production, and pharmaceuticals. While challenges such as raw material price volatility and regulatory pressures persist, innovations in bio-based production and sustainable chemical processes are shaping the industry’s future.

Companies investing in green chemistry initiatives, advanced catalytic methods, and high-purity acetic acid will lead the market in the coming decade. As industries continue to move toward eco-friendly and high-performance materials, acetic acid remains a cornerstone of modern chemical manufacturing.